Commentaires

Electrification nation

07 mars 2024

It’s no secret that the US electrical grid is in a dire state now more than ever. Most of the infrastructure we see today was built in the 1960s and 1970s, with over 70% being more than 25 years old. Marked by significant and consistent underinvestment, the US grid continues to experience increasing supply disruptions, blackouts and fire incidents. Maintenance and repair are perpetual needs. A notable example of maintenance disrepair happened last year with the Hawaiian Electric fire. In August 2023, Maui County sued Hawaiian Electric, the state’s largest supplier of electricity, accusing the utility of negligence in what became the deadliest US fire in over a century resulting in thousands of acres burned and over 100 fatalities.

The push for electrification

Additionally, with rising population levels and the ongoing push for electrification, the grid is ill-equipped to manage the volume of electricity being transmitted through existing power lines. Electricity demand in the US is expected to increase by 18% by 2030 and 38% by 2035. This increased electricity transmission will be driven by the transition to electric vehicles as well as the build out of carbon-neutral energy sources, namely renewables.

Facing the future: investment and innovation

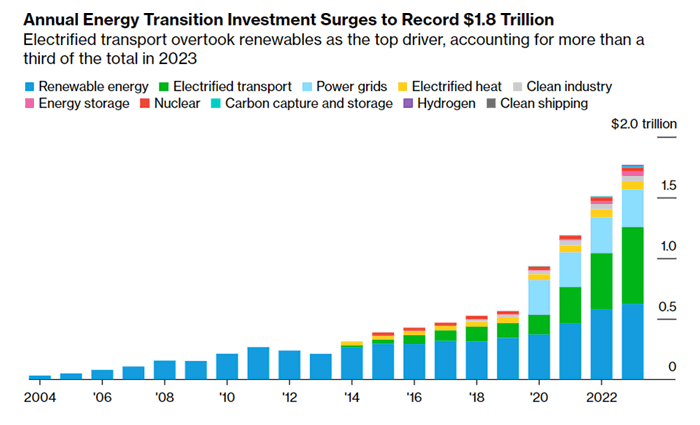

To meet the rising demand and supply of electricity, significant augmentation and expansion of the current grid, with substantial resources invested, will be necessary. Several states have already announced massive investment projects to address these needs. Notably, in October 2023, the Biden-Harris administration announced a USD$3.5 billion funding initiative for 58 projects across 44 states for grid infrastructure, signalling the beginning of extensive future investments. The International Energy Agency estimates that, by the end of the decade, over $600 billion a year will need to be invested globally to ensure a resilient supply of clean and reliable electricity. In fact, from 2020 to 2023, global grid investments have grown from USD$285 billion to over USD$310 billion.

Source: BNEF

These developments make the grid infrastructure trend one we are closely watching as we seek to identify companies poised to benefit from this theme.

Nexans: a catalyst for change

One such company is Nexans (NEX FP), a recent addition to our portfolio that stands to gain from escalating investment in US grid infrastructure over the next decade. A France-based cable manufacturer with a significant presence in the US, Nexans specializes in producing high, medium and low voltage transmission cables and serves a variety of end markets.

Several years ago, recognizing the global trend towards electrification, Nexans decided to realign its portfolio to become a pure electrification player by 2024, committing to divest from three divisions unrelated to this goal, namely telecom, auto harness and a portfolio of small unrelated segments.

2023 marked a transition year for the company as it intensified its refocus efforts. This was met by some volatility in its stock price due to a challenging market environment that made divestment difficult along with uncertainties in offshore wind markets. However, the company has recently shown significant progress and is delivering on its portfolio transition ahead of schedule. Moreover, offshore wind markets in the US are experiencing renewed positive sentiment, evidenced by strong auction prices that de-risked them last week. Nexans’ stock price has rebounded from a multiyear low in October 2023 to a multiyear high and we remain optimistic about the company’s future prospects and its successful transition to full electrification.