Commentary

Small cap is back: 7 reasons to buy small caps in a recession

November 17, 2022

According to research by the Bank of America, global risk assets have lost over $35T since November 21, 20211. This should come as no surprise as we are seeing: the co-dependency of Wall Street and the Fed, stop-go economic policies, zero COVID policy in China, headline inflation, political instability, war, oil and food shocks, fiscal excess, and industrial unrest.

Given all this volatility, recession is a common topic of conversation among investors and companies. The general consensus? Avoid small cap stocks and stick to the so-called safer large cap companies.

In today’s weekly, we’re busting this myth by explaining why small cap is back and why exposure to this asset class is your best bet during a recession. We’ll begin with a brief trip down memory lane.

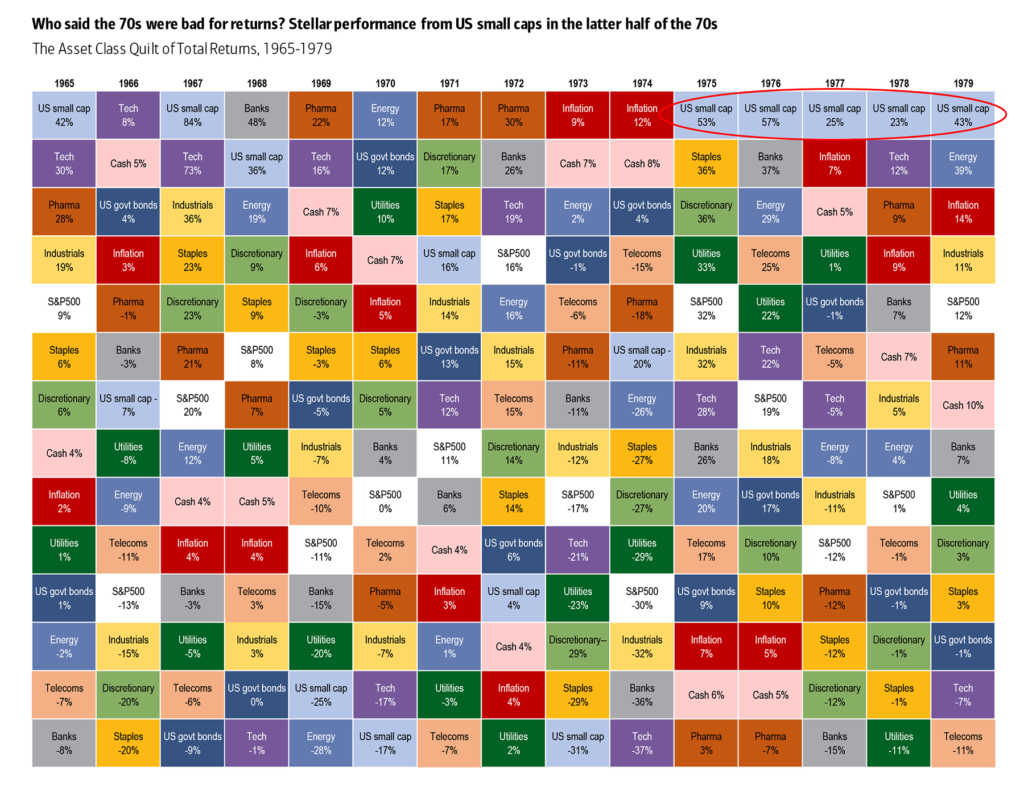

1970s – Small caps shine amid economic volatility

Investors assume that for small cap to outperform, we need economic certainty, lower rates and better credit conditions. But history proves otherwise. The 1970s were one of the best decades for small cap, and yet this era was plagued with a wide variety of economic volatility.

Throughout the 70s, inflation averaged 7.1% with a high of 13.3%. Fed rates peaked at 14% in 1979 from 3.5% in 1971. The economy faced oil shocks, embargoes, and taxes were high. Real economic growth was below the previous decade by 1%, and productivity was even lower. Meanwhile, President Richard Nixon became the first U.S. president to resign, and the dollar abandoned the gold standard and devalued.

Incredibly, in the midst of all this uncertainty, small cap outperformed large. Why?

Why small cap succeeds during unexpected inflation

What really helped small cap outperform during the 70s was the unexpected inflation. According to Aswath Damodaran, a finance professor at NYU Stern, there are two reasons why unexpected inflation benefits small cap companies.

- Nimbleness in price adjustments – Large cap stocks, with their layers of management, have very entrenched pricing models. On the contrary, small cap can quickly change pricing structures to reflect the new inflationary environment. Hence, small cap reports much better margins.

- Less long-term investment projects – Large cap generally undertakes investment projects, which can have a 10 to 30-year timeline. They need to think much longer term just to maintain their growth rates. The problem is during high inflationary and interest rate environments, the Net Present Values for the projects drop drastically as cost and revenue inputs change. By contrast, small cap companies are in growth ramp-up mode and have a long runway for potential expansion.

Why is now the time to buy small cap?

With inflation at 8.3%, the probability of a recession in the U.S. is almost certain. Earning season is already indicating lower earnings growth, especially for large caps.

Meanwhile, central banks are raising rates across the globe. It goes without saying, we are in a very uncertain economic environment. So let’s break down the top seven reasons to invest in small cap right now.

1. A history of long-term outperformance – small cap stocks have consistently outperformed large cap over the long term by a considerable amount.

2. Unexpected inflationary environment – The data shows that small cap consistently outperforms large cap during unexpected periods of inflation.

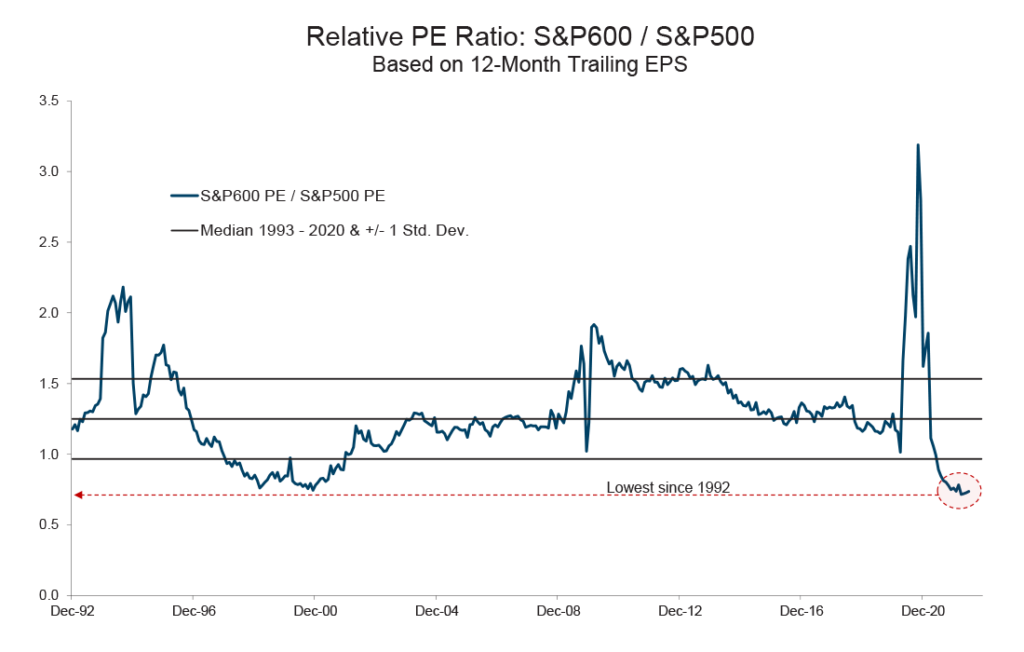

3. Valuation – Perhaps most compellingly, small cap is very cheap compared to large cap stocks. The below chart shows that the relative P/E of the S&P 600 (which excludes negative P/E stocks) versus the S&P 500 is the lowest since at least 1992.

The story is similar if we look at the Russell 2000. The last time it traded at this depressed relative multiple to the S&P 500 was during the dot-com bubble burst. From 10/9/2002 to 10/9/2007, Russell 2000 outperformed the S&P 500 by more than 50%.

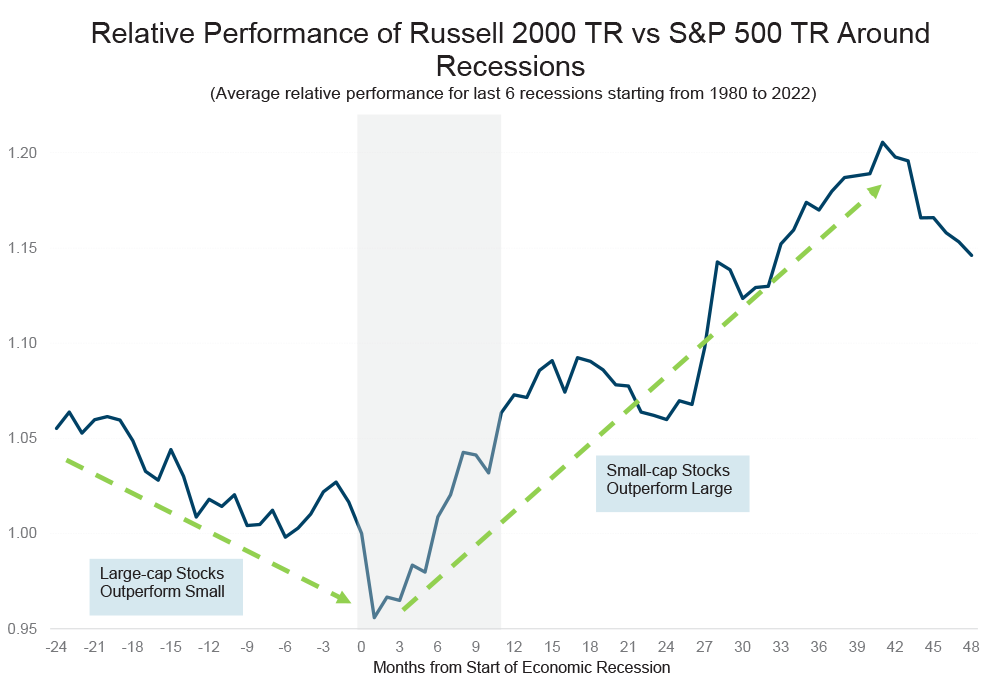

4. Small cap does well from early in the recession – While we do not know exactly when a recession will begin, it certainly feels like we’re getting close. So, getting exposure to small cap now would be a great idea for long-term investors. Small cap stocks have outperformed large cap in each of the previous six recessions that we have data for, going back to 1980.

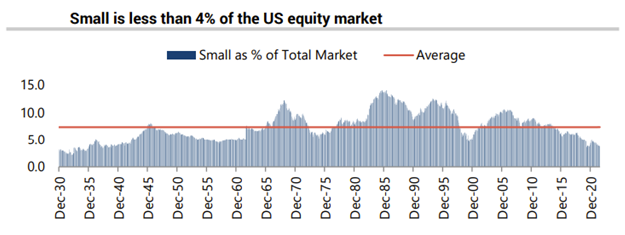

5. Low exposure – The percentage of small cap in the U.S. equity market now stands below 4%, a level last seen at the COVID bottom. Prior to this point, we must go back to the 1930s to see such little exposure to small cap. As investors will increase their allocation to the asset class, patient investors will be rewarded.

6. M&A is another consistent tailwind for small cap – Small cap represents approximately 95% of all deal volumes globally. The average acquisition premium is in the range of 35-40%.

7. Undercovered – Small cap is far less researched than large cap. Globally, small cap is covered on average by three brokers, versus 16 that cover the average large cap. There are hundreds of small caps in any region still not covered by a single broker. This provides bigger alpha opportunities for investors.

Final thoughts

When it comes to small cap outperforming large cap during recessions, we see the same trends play out across the globe. For example, valuations in Europe have dropped to levels last seen during the Global Financial Crisis (GFC).

So, now is the time to increase exposure to small cap, as most investors are underweight in this asset class. At Global Alpha, we are patient long-term investors who should benefit as small caps return to their historical outperformance and take a market leadership position.

1BoA Securities Global Research: The Flow Show – The Next Big Thing is Small, November 3, 2022