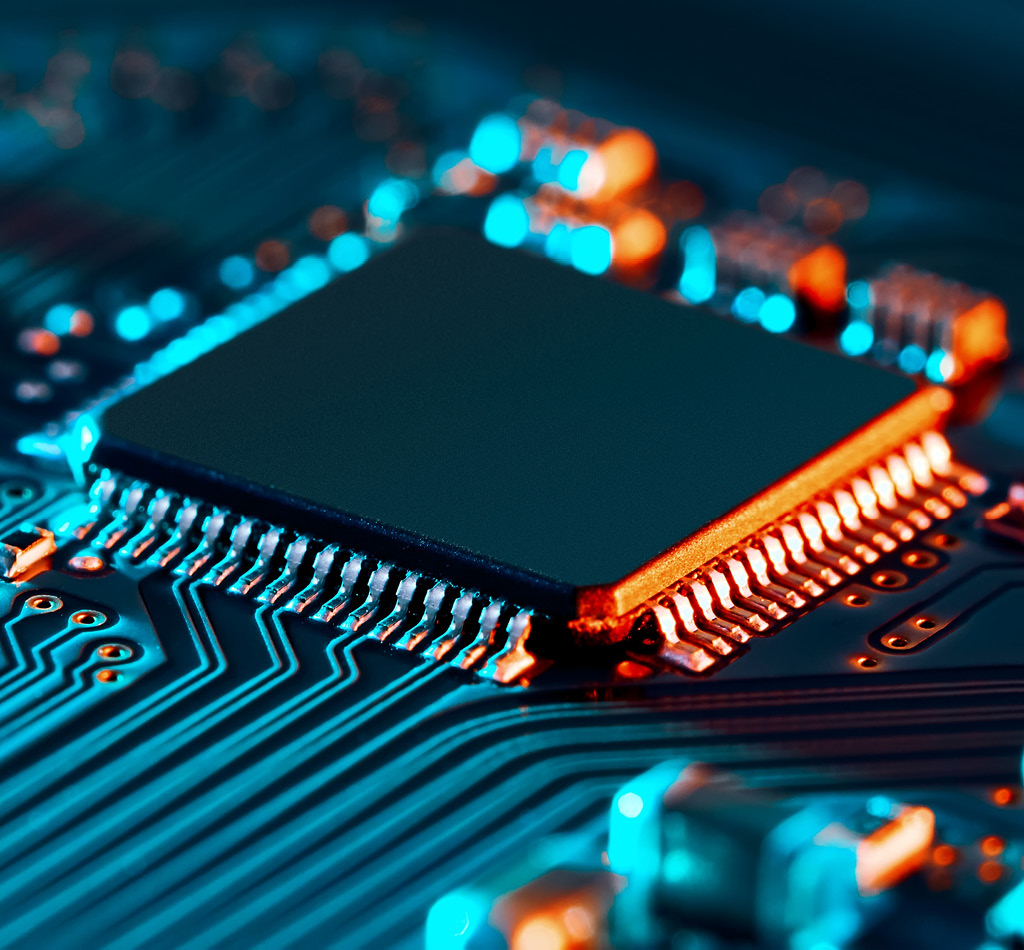

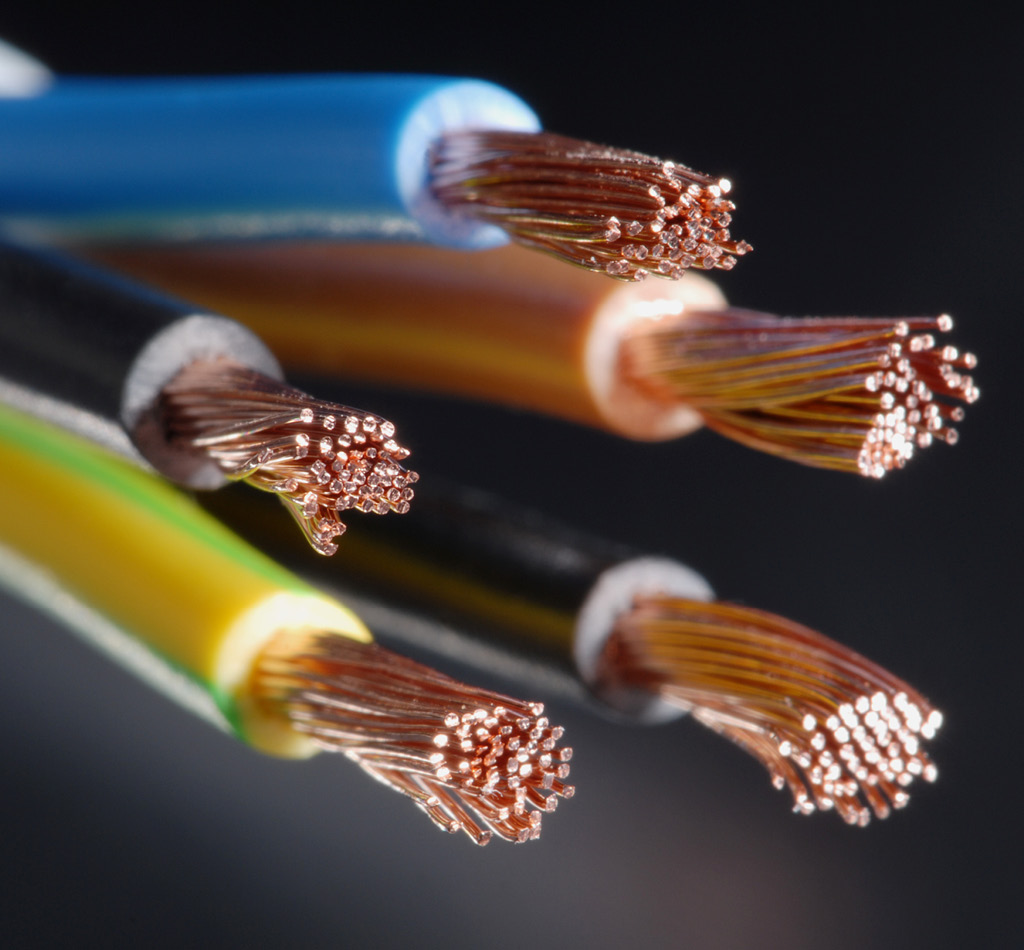

Capstone Copper: Positioned to benefit from a structurally tight copper market

February 12, 2026

Copper markets are entering a structurally tight phase while Chile’s evolving policy backdrop is improving the outlook for long-life, capital-intensive mining assets.