Commentary

Oil’s not well

August 3, 2023

Much of the initial spike in inflation that the Federal Reserve (the Fed) is now working so hard to curb came from strong energy prices. After WTI crude crossed $120 a barrel, energy prices are back in the $70 range. Today’s bear case for oil is widely discussed – from an impending recession to China’s tepid economic rebound and the eventual transition to EV vehicles. These are sensible arguments, but the oil and gas industry has undergone some structural changes. The seeds of these changes can be traced back to the last big run up in oil prices in 2008 when oil peaked at close to $140 a barrel.

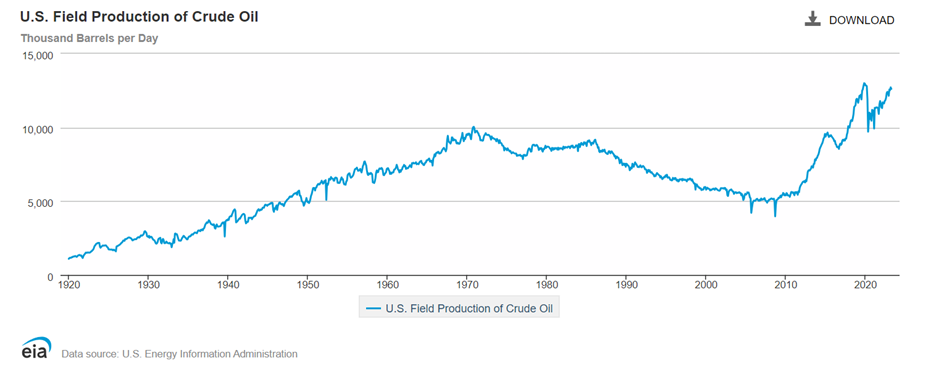

After the demand-driven boom that peaked in 2008, encouraged by the recent high prices oil, drillers in the US began exploring ways to reach previously untouchable deposits using fracking and horizontal drilling. While fracking and horizontal drilling had been around since 1998, the spike in oil prices incentivized US producers to leverage this technology. The result was a shale boom with US production that had been in terminal decline since the 1960s, doubling from about five million barrels per day in 2008 to 10 million per day over the next 10 years.

With OPEC unwilling to cede market share to a new generation of American drillers, elevated rates of supply eventually led to a fall in prices in 2014-15. In retrospect, this marked the beginning of the end of the US shale boom. Then came the one-two punch of slowing demand from China (the largest driver of incremental demand for oil) and COVID-related lockdowns that caused oil prices to hit lows of $20 per barrel in 2020 after a brief reprieve in 2018-19.

The two price shocks that occurred over a short period led to two changes in behaviour that we think has structurally changed the industry.

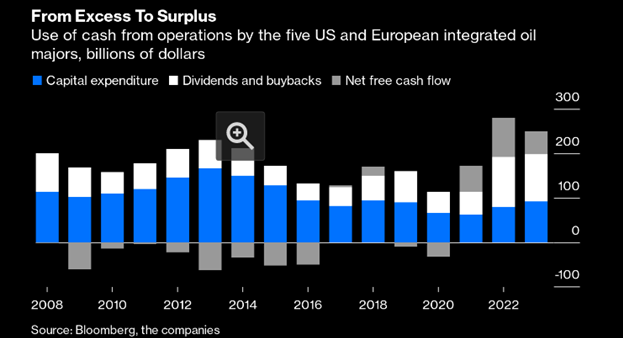

- First, a new base of conservative investors replaced the more growth-oriented cohort from the shale boom. The new investor base now pushed for an end to risky new projects, instead focusing on debt reduction and returning excess cash in the form of buybacks and dividends.

- Second, taking a cue from their investor base, management of companies that survived this boom-bust cycle vowed to be conservative with their capital expenditure programs and promised to divert their future capex to more renewable projects.

In the past, for every dollar of dividends and buybacks, oil companies would reinvest $3 to $4 back in the business. Now as we can see in the following chart, every $1 of reinvestment is matched by $1 of buybacks and dividends.

The result of this structural change in the market is that big oil producers will continue to be conservative with projects that take a decade or more to earn returns on investment. We are now in a situation where supply is tight due to both long-term factors, such as limited new exploration projects, and short-term factors like replenishment of the Strategic Petroleum Reserve (SPR) by the US, increasing from current levels of 350 million barrels to 650 million barrels. Adding to this, OPEC has committed to restricting supply until the end of 2023 by cutting 1.16 million barrels per day.

On the demand side, we are seeing record demand in 2023 at 101.9 million barrels per day, an increase of two million barrels from last year. While we anticipate an eventual transition away from oil, the combination of tight supply and persistent rising demand could lead to a messy transition with price spikes near-term volatility.

We think this new normal allows small and nimble players to quickly respond to a stronger pricing environment with ramped up spending. A good example of such a player is Parex Resources (PXT CN), which is part of our emerging markets portfolio.

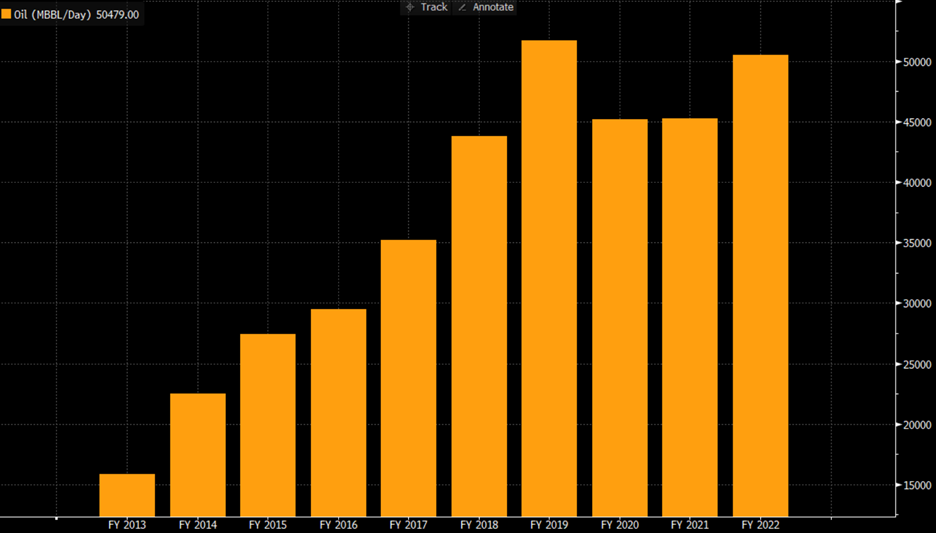

Parex is the largest independent oil and gas exploration company in Colombia sitting on over 200 million barrels of reserves and exploration opportunities. In 2023, it added 18 new blocks and expanded its exploration land by four million acres over the last five years. Currently, it produces 60,000 barrels of oil equivalent (BOE) per day and its production has grown at an 8% CAGR over the last five years, as seen in the following chart. Absolute proved developed producing (PDP) reserves have registered a 10% CAGR over the same period.

Consistent growth in oil production (barrels per day)

If we were to sum up our thesis on Parex, it would be capital efficiency with best-in-class execution. All of this in a country that has faced its fair share of curveballs with natural disasters, political uncertainty and infrastructure bottlenecks. To elaborate further:

- We like Parex’s transition from a single-asset operator to a countrywide operation, with new asset acquisitions and an MOU with state giant EcoPetrol.

- This had led to product diversity, moving from heavy oil to adding light oil, gas and condensates.

- Parex has a track record of using of proven exploration technologies from the West to tap into easy-to-produce reservoirs with low risk.

- We appreciate the management team’s commitment to adding shareholder value while maintaining strict cost control.

- Finally, Parex has shown consistent growth that has been self-funded, with zero debt on the balance sheet.

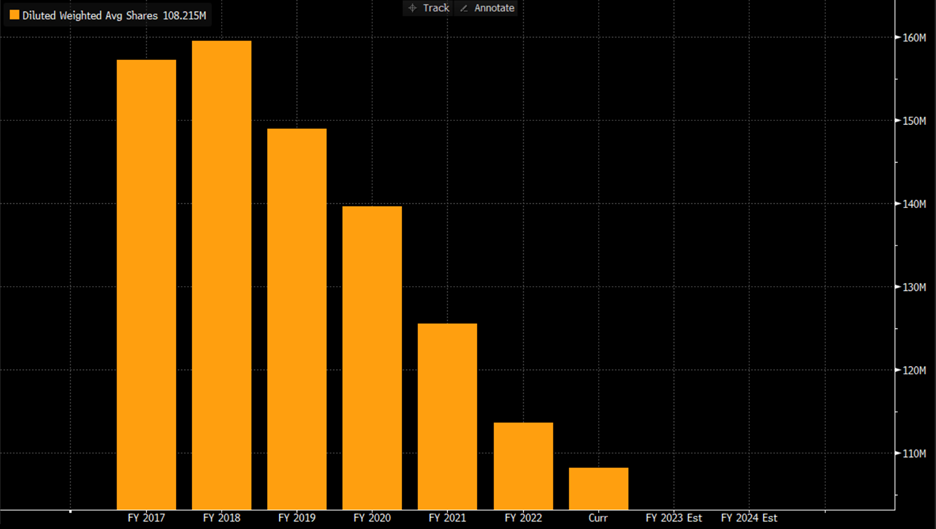

Parex has maintained a simple and consistent capital allocation framework. A full two-thirds of its funds from operations are reinvested into the business, while the remaining one-third is returned to shareholders. As seen in the chart below, Parex has reduced its free float of shares by 33% over last five years and returned $1.3 billion back to shareholders. In 2021, it announced a dividend policy to further reward shareholders, with the company offering a 5% dividend yield at current prices.

33% reduction in shares outstanding

Parex also scores well on our ESG framework. It has reduced GHG intensity by 43% since 2019, linked executive compensation to ESG metrics and has a diverse and independent board. With a low cash cost, Parex has performed well even at today’s subdued oil prices. If a sustained period of high oil prices does materialize as we anticipate, we expect Parex to continue delivering shareholder value from a position of strength.