Commentary

Insights from our recent trip to Poland and Turkey

May 2, 2024

In March, our team embarked on a two-week trip to two of the most dynamic economies within Emerging Markets: Poland and Turkey. During our visit, we engaged with companies spanning a variety of industries – from construction and renewable energy to waste management, IT, commercial services, airlines and airport operators. Also, we gained insights into the consumer sector, meeting with leaders in production and distribution for a wide range of consumer products, including confectionery, fast food, denim, automotive, electronics, soft drinks and beer. The trip’s objective was not only to check up on existing holdings but also to identify nascent opportunities and understand the challenges these businesses face.

Poland’s optimistic outlook

It has been a year since our previous visit to Poland. During that visit, we observed consumers struggling with high inflation, wage growth continuing to decline, public concerns around the upcoming parliamentary elections and hopes for a swift resolution to the war in Ukraine, which would bring peace and vast opportunities for Polish companies.

We were happy to see a rise in optimism regarding these concerns during our latest visit. Most of our interviewees were more bullish this time around. Post the parliamentary elections, we sensed a renewed optimism as a pro-European Union (EU) coalition regained power. The new Polish government seems committed to mending relations with the EU, having successfully unblocked the first tranche of €76 billion frozen by the European Commission due to legal concerns after judicial reforms by the former government. Since joining the union, Poland has been a significant beneficiary of EU funds, receiving approximately €164 billion from 2004 to 2020. For context, Poland’s GDP was €750 billion last year. These substantial financial inflows have contributed to various crucial projects across the country, enhancing infrastructure and improving structural economic growth and overall wellbeing. No wonder these EU funds are expected to drive economic growth for several years to come. Coming in the form of grants and low-interest loans, this financing is mainly for funding infrastructure and renewable energy projects.

Contrary to last year, this time we saw consumers in Poland enjoying strong real wage growth of around 10%, with no labour market slowdown. With inflation easing to low single digits in the first quarter of 2024, these factors create a conducive backdrop for the robust recovery of Polish consumers. Growing disposable income is likely to not only rebuild their savings but also drive rebound in consumption.

However, the road ahead may be bumpy due to potential inflation spikes in the second half of 2024 on the back of higher energy prices, a VAT hike on groceries, fulfillment of costly pre-election commitments, domestic political tensions and the potential escalation of the ongoing war in Ukraine. The war remains one of the major risks to the region and was a frequent topic in our conversations, not only with corporate executives but also with ordinary citizens. Centuries of conflict between Poland and Russia have left deep scars in the psyche of the average Polish citizen.

Turkish economic reforms and investor confidence

In Turkey, a surprising pivot to orthodox monetary policy last year reignited hopes for economic normalization, buoyed the local stock market and turned foreigners in net buyers for the first time since 2019. Committed to controlling escalating inflation, the central bank raised its key policy rate from 8.5% in June 2023 to a staggering 50% in March 2024. Moreover, the monetary authority signaled its readiness for further rate hikes if necessary. Investors welcomed the government’s adoption of market-friendly measures, which drove the Turkish stock market higher by over 30% in US-dollar terms since the first hike last summer. Simultaneously, foreign reserves have started to recover, sovereign credit spreads have tightened to multi-year lows and the current account balance is expected to get meaningful support from the tourism season starting in May.

Although the recent municipal elections marked a significant defeat for the current leadership, President Erdogan reiterated policy continuity and his commitment to an economic turnaround program in the second half of the year. With no elections for the next four years, the government has time to tackle inflation and achieve long-awaited results. However, this requires the implementation of further austerity measures, including fiscal ones. Current market expectations see inflation peaking in May above 70% before declining to 30%-40% by year-end. However, potential new rounds of minimum wage hikes, premature rate cuts and higher energy prices continue to threaten the turnaround policy and could derail efforts to reduce inflation and improve the trade balance.

Nearshoring opportunities

Despite being influenced by very different forces, Poland and Turkey share some commonalities. In the last few years, the term “nearshoring” has become strongly associated with Mexico and Vietnam. We explored the impact on the Mexican economy in a previous commentary. However, Poland and Turkey have turned out to be underappreciated beneficiaries of supply chain shifts toward near- or friendshoring as a way to reduce reliance on China. Nearshoring opportunities repeatedly came up in our discussions with corporates in both countries. We see Poland as a launching pad for opportunities into Western Europe and hard-to-access markets in the east like Hungary, Romania and Bulgaria. Similarly, Turkey offers a gateway to explore opportunities in CIS countries and less liquid frontier markets. We highlight one such opportunity below.

As bottom-up investors, we focus our macroeconomic analysis primarily on enhancing the risk management aspect of our portfolio management. When investing in highly turbulent economies, we prefer to stick to companies that we believe can succeed even when their domestic economies face challenges. Additionally, we look to benefit from a possible decline in country risk premiums in the event of macro normalization.

Investment spotlight: Coca-Cola Icecek and Mo-BRUK

Our largest position in Turkey is Coca-Cola Icecek (CCOLA TI), a coke bottler. In the last 20 years, the company has evolved from a single-country operator to the third-largest coke bottler globally, with a footprint spanning 12 countries and 600 million people. Icecek generates less than 30% of its EBITDA in Turkey, with Pakistan, Kazakhstan, Uzbekistan and another eight countries in the Middle East and Central Asia accounting for the major part of the business. Robust strategic alignment with The Coca-Cola Company, combined with Icecek’s proven record of successful integration, positions it as the preferred partner for further consolidation of Coca-Cola’s bottling operations in the region.

Bangladesh is the recent addition to Icecek’s portfolio. It is a country with over 170 million people and a heavily underpenetrated non-alcoholic beverage industry poised for double-digit volume growth over the next decade. This positions Icecek well to replicate its successful strategy of distribution network enhancement to ensure product availability, build infrastructure and enrich merchandise offerings. Leveraging its leading brand portfolio and a highly experienced management team, Icecek is set to continue capitalizing on the vast potential of its markets.

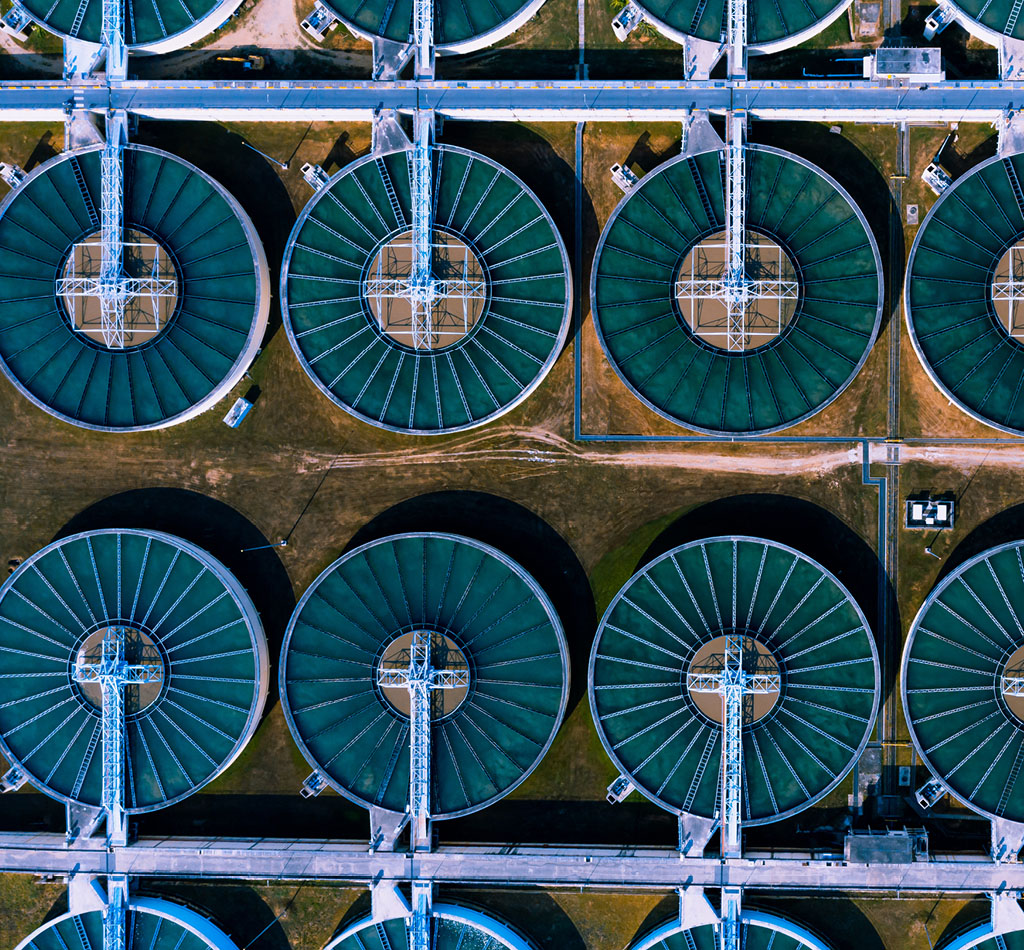

Mo-BRUK (MBR PW) is a waste management company in Poland specialized in processing hazardous waste. The founding family established the business more than 30 years ago and has built a strong franchise in an industry characterized by high entry barriers. The company does not operate landfills and focuses solely on processing waste. EU regulations on waste management create significant tailwinds for the industry in Poland, as the country must undertake considerable efforts to meet EU objectives. Due to its specialization in hazardous waste and limited competition due to entry barriers, Mo-BRUK enjoys superior business economics. High margins are driven by volume growth and technology improvements, as well as price hikes due to limited capacities in the country. In terms of growth strategy, the company is conducting several expansion projects within available permits. At the same time, it is filing for new permits. Remediation of the illegal landfills or so-called ecological bombs represents an attractive business for Mo-BRUK, but it is highly dependent on the budget allocation by municipalities. The cadence of such projects is erratic, but the company intends to participate in all tenders as they are announced. Additionally, the management team sees multiple consolidation opportunities in the country. In late-2023, Mo-BRUK acquired two independent operators that not only provided the company with scarce permits but also expanded its footprint in northern Poland.